1. Joseph Coterill of FT Alphavile has a couple diagrams of the Finnish proposal to collateralise Greek assets. He discusses the negative pledge problem which basically says that Greece is not allowed to seek further foreign law bonds that are prejudicial to existing foreign law bonds. And if Greece doesn't get a waiver of this clause from the bondholders and then gets another foreign law bond, then it will be in default. Beautiful self snooker.

Source: Joseph Coterill (Aug 30, 2011) http://ftalphaville.ft.com/blog/2011/08/30/664341/finlands-greek-collateral-plan-breaks-negative-pledge/

Coterill then states that the Finns are spinning this negative pledge block into an opportunity to obtain more credit enhancement. So question is who and what will be used for credit enhancement? Earlier today, Zerohedge made the same point from a bit broader perspective:

"So instead the country's banks need direct foreign capital. However, this capital needs hard collateral pledged. Collateral which would have value in a worst case scenario, i.e., liquidation. Instead, what the EFSF has offered as "collateral" is the equity of the very same firms which will be immediately insolvent once this house of cards collapses, sending the bank equity collateral worthless, and buried under billions of debt liabilities, and in turn impairing the ECB which suddenly finds itself with hundreds of billions in worthless Greek paper, making additional funding for Finland, once it finds itself in a liquidity crisis, next to impossible."

Source: http://www.zerohedge.com/news/europes-ponzi-takes-twist-wacky-greek-bank-equity-be-used-loan-collateral

Source: Ibid.

3. How about a super credit enhancement? Why not borrow some AA+ US treasuries using the US Fed recently re-opened swap lines? A fiat currency denominated debt paying 100% value (after whopping fat Swiss commissions of course) for Greek assets. During TARP, the US Fed conducted the "dead mice" trade where it would pay 100% for RMBS having no tradable value. The US Fed could, should and maybe even would again "save" the world by accepting the "dead mice" from Greece. By the way, this does not have a nice ending.

Recommended reading: Kindleberger on Manias, Panics and Crashes.

These are notes on law and finance written from philosophical, anthropological and categorical theory perspectives.

Wednesday, 31 August 2011

Good Contracts: Moral Principle 2 - Commutative Justice

1. St. Thomas Aquinas identified 3 virtues which serve as criteria for determining whether a contract qualified as morally good. In a previous note, we detailed the first virtue called Promise-keeping. In this note, we investigate the second virtue, Commutative Justice. And in a future note, the third, liberality.

2. Commutative Justice is the most conceptually mathematical of the three virtues. Commutative simply means that which relates to exchange, substitution or interchangeability. In mathematics, to say something commutes means that we can change the order of operations and obtain the same result. This idea is central to how we think of operations in the abstract, and generally speaking, when we say we can be sure something is the same as another, it is probably because we would also hold that there is a commutative relation to our beliefs. We'll speak a lot more about commutativity when we investigate Category Theory. But for now, we examine St Thomas' not so primitive bifurcated concept of commutative justice. First, the Arithmetic and then, the Geometric.

3. Arithmetic Commutative Justice. The Arithmetic arises in a bilateral exchange formation. When two parties exchange goods for value, the Arithmetic justice is simply that the value between the parties should be relatively equivalent or balanced. The notion of balancing equivalence probably comes from the act of using scales to measure a point of equivalence by approximating the point of equivalence by adding (or subtracting) lesser weights In this way, fairness can be found by the operation of addition. For about 8 centuries, this concept of fairness in bilateral exchange comes back frequently in the law, despite attempts to relegate it into meaninglessness under 19th century morally de-linked interpretations of contracts. See, for example, the doctrine of "nominal consideration" where mere legal recital of a valued for exchange is sufficient to overcome the bar of unfairness. Note also that in more recent consumer contract legislation from the mid-1960's, there are explicit attempts to bring back this sense of fairness where there is very unequal bargaining power between the corporate monopolistic price-setter and debt-addicted consumer slave. In a high powered radical reconceptualisation of Arithmetic Commutative Justice (ACJ, please forgive the acronym because life is too short to spell everything out explicitly), we see its reflection in a Risk Symmetries Framework where the x-axis is Perceived Risk and the y-axis is Definition (i.e. Increments of information) where horizontal line segments divided into equivalent length left and right segments relative to a middle vertical line represent a fair trade of perceived risk. Under a Risk Symmetries Framework, we have the theorem: Equivalent bilateralisation of perceived risk between two parties at the same level of Definition results in a commutative risk trade. This will become clearer much later on--hopefully, I can explain what this means clearly enough so we can use it in a natural way to understand risk in our daily lives. Some of my students know that I have an 80 page unpublished paper on the Risk Symmetries Framework which explains modern finance theory and behavioural finance theory locked up in my drawer which is based on answering the question, "What is the fundamental unit of psychological space that preserves risk?" When I wrote it, I thought it could be based on group theory. Now, I realise that that was much too narrow a view. Anyway, this is a digression. Let us return to commutative justice of the Geometric kind.

3. Geometric Commutative Justice (GCJ). If ACJ involves two parties, then GCJ involves groups of three or more. Just as we are concerned with distribution in ACJ so are we with GCJ. The question is naturally how to distribute equally among many. Aristotle and St Thomas appear to be socially or social structurally conservative on this point. Note when Aristotle uses the term "individual," he means the class of individuals. So distribution to various groups means distribution in proportion to those classes or groups of individuals. Compare the normativity of say Rawls' second formulation of his principle of justice wherein we are asked to imagine the most socio-economically deprived class of individuals in society, and to not implement any law that would do harm to such a group. The Aristotelian-Aquinian position by contrast would say that so long as the distribution to the various groups in society replicated the hierarchical structure of society, that would be considered just. For Aristotle and St Thomas, we have a ready reckoning tool where geometric justice simply means to replicate the interests of those in the existing social hierarchy while for Rawls, everyone is tasked to become a Socratic philosopher questioning every law for the sake of protecting those most vulnerable to its effects. What may be interesting is to determine which groups various presidential candidates intend to replicate. For example, Obama appears to exaggerate the differences between groups in the socio-economic hierarchy (classic class war rhetoric) and for this reason, he appears geometrically commutatively unjust to all groups in society. Strange place to be in? Obviously, back room deals with Wall St and war mongering without Congressional approval just don't add up for all Americans.

2. Commutative Justice is the most conceptually mathematical of the three virtues. Commutative simply means that which relates to exchange, substitution or interchangeability. In mathematics, to say something commutes means that we can change the order of operations and obtain the same result. This idea is central to how we think of operations in the abstract, and generally speaking, when we say we can be sure something is the same as another, it is probably because we would also hold that there is a commutative relation to our beliefs. We'll speak a lot more about commutativity when we investigate Category Theory. But for now, we examine St Thomas' not so primitive bifurcated concept of commutative justice. First, the Arithmetic and then, the Geometric.

3. Arithmetic Commutative Justice. The Arithmetic arises in a bilateral exchange formation. When two parties exchange goods for value, the Arithmetic justice is simply that the value between the parties should be relatively equivalent or balanced. The notion of balancing equivalence probably comes from the act of using scales to measure a point of equivalence by approximating the point of equivalence by adding (or subtracting) lesser weights In this way, fairness can be found by the operation of addition. For about 8 centuries, this concept of fairness in bilateral exchange comes back frequently in the law, despite attempts to relegate it into meaninglessness under 19th century morally de-linked interpretations of contracts. See, for example, the doctrine of "nominal consideration" where mere legal recital of a valued for exchange is sufficient to overcome the bar of unfairness. Note also that in more recent consumer contract legislation from the mid-1960's, there are explicit attempts to bring back this sense of fairness where there is very unequal bargaining power between the corporate monopolistic price-setter and debt-addicted consumer slave. In a high powered radical reconceptualisation of Arithmetic Commutative Justice (ACJ, please forgive the acronym because life is too short to spell everything out explicitly), we see its reflection in a Risk Symmetries Framework where the x-axis is Perceived Risk and the y-axis is Definition (i.e. Increments of information) where horizontal line segments divided into equivalent length left and right segments relative to a middle vertical line represent a fair trade of perceived risk. Under a Risk Symmetries Framework, we have the theorem: Equivalent bilateralisation of perceived risk between two parties at the same level of Definition results in a commutative risk trade. This will become clearer much later on--hopefully, I can explain what this means clearly enough so we can use it in a natural way to understand risk in our daily lives. Some of my students know that I have an 80 page unpublished paper on the Risk Symmetries Framework which explains modern finance theory and behavioural finance theory locked up in my drawer which is based on answering the question, "What is the fundamental unit of psychological space that preserves risk?" When I wrote it, I thought it could be based on group theory. Now, I realise that that was much too narrow a view. Anyway, this is a digression. Let us return to commutative justice of the Geometric kind.

3. Geometric Commutative Justice (GCJ). If ACJ involves two parties, then GCJ involves groups of three or more. Just as we are concerned with distribution in ACJ so are we with GCJ. The question is naturally how to distribute equally among many. Aristotle and St Thomas appear to be socially or social structurally conservative on this point. Note when Aristotle uses the term "individual," he means the class of individuals. So distribution to various groups means distribution in proportion to those classes or groups of individuals. Compare the normativity of say Rawls' second formulation of his principle of justice wherein we are asked to imagine the most socio-economically deprived class of individuals in society, and to not implement any law that would do harm to such a group. The Aristotelian-Aquinian position by contrast would say that so long as the distribution to the various groups in society replicated the hierarchical structure of society, that would be considered just. For Aristotle and St Thomas, we have a ready reckoning tool where geometric justice simply means to replicate the interests of those in the existing social hierarchy while for Rawls, everyone is tasked to become a Socratic philosopher questioning every law for the sake of protecting those most vulnerable to its effects. What may be interesting is to determine which groups various presidential candidates intend to replicate. For example, Obama appears to exaggerate the differences between groups in the socio-economic hierarchy (classic class war rhetoric) and for this reason, he appears geometrically commutatively unjust to all groups in society. Strange place to be in? Obviously, back room deals with Wall St and war mongering without Congressional approval just don't add up for all Americans.

Monday, 29 August 2011

Moral Virtue Número Uno: Promise-keeping->Detecting Frausters->Gravest Punishment is Being Laughed Out of Court

1. In the St Thomas Aquinian view of the moral foundations of contracts, there are 3 virtues: (1) promise-keeping, (2) commutative justice and (3) liberality. A contract may be said to be good morally if it satisfies at least one of these criteria. In a previous note, I had defined these virtues. I'd like to argue that fraudsters are simply those who can't keep promises. Now, there is a lot of research on "how and why people lie" but the main points of this note are on "How to detect fraudsters?" and "What to do after detection?"

2. Fraudsters are easily detected by simply checking their references. Madoff, the $60 billion fraudster who got a 150 year jail sentence lied convincingly all the way up to the day he confessed. I heard that Judge Denny Cheng, who handed out the sentence was swayed by evidence showing Madoff's hardened heart. On the day before publicly confessing, a widow with a handicapped daughter told Madoff that she was giving him all her money and that this was all they had to support herself and her daughter. Madoff put his arm around the lady and whispered, "Don't worry. I'll take care of you and your daughter." He took her money and the next day announced to the world he was broke. I researched Madoff (and created a 50-page anti-fraud checklist based on a complaint against Madoff's main feeder fund called Fairfield --this could be useful to investors and fund managers and I have parked it in my computer) and found that one of the reasons he was able to dupe people is because the duped never bothered to check his references! In Europe, he would name 6 US banks and in the US, he would name 6 European banks. The duped never bothered to check. The bankers who did check never did business with Madoff. In today's world, you should be very careful about physical gold, gold funds and hi-return sovereign bond funds. Anyone selling you these are very dangerous, indeed!

3. What to do with a fraudster after you've detected one? This depends on you. Remember a fraudster is a bit charming, so in the majority of meetings, you will end up paying. Remember nothing is for free and that deals that "have no risk" or offer an abnormal rate of return, or something for which you don't need to pay the full price either or both in terms of time or money, are simply "junk." One of the insanely funny things I learned while trading as an investment banker is that I couldn't trust my "boss" or his "boss" to tell me the truth about anything that affected my personal welfare. I learned to take statements such as "believe me" from my superiors to be the strongest sell signals! I recently experienced a very similar incidence of this sort of funny behaviour at a university. And when I use to employ people, I found they would dip their hands in the cookie jar. In governance theory, we call this the agency problem. The classic agency solution is to offer employees a stock option scheme! Laughable, no? Will a stock option scheme eradicate dishonesty, lies, cheating and stealing? I don't think so.

4. Best is to be vigilant. In Aikido, if someone had broken the code of conduct, eg, broken a promise to a Sensei, stolen from the dojo, lied in public etc., the punishment was quite amazing. The punishment wasn't a stripping of one's rank or being thrown out of the dojo or even a demotion. The gravest punishment was to be called before the senior teachers and for the teachers to "laugh." No fraudster wants to be laughed at. It means he or she cannot be taken seriously. Next time you come across a fraudster, try laughing. It usually is disconcerting enough to spill the beans.

2. Fraudsters are easily detected by simply checking their references. Madoff, the $60 billion fraudster who got a 150 year jail sentence lied convincingly all the way up to the day he confessed. I heard that Judge Denny Cheng, who handed out the sentence was swayed by evidence showing Madoff's hardened heart. On the day before publicly confessing, a widow with a handicapped daughter told Madoff that she was giving him all her money and that this was all they had to support herself and her daughter. Madoff put his arm around the lady and whispered, "Don't worry. I'll take care of you and your daughter." He took her money and the next day announced to the world he was broke. I researched Madoff (and created a 50-page anti-fraud checklist based on a complaint against Madoff's main feeder fund called Fairfield --this could be useful to investors and fund managers and I have parked it in my computer) and found that one of the reasons he was able to dupe people is because the duped never bothered to check his references! In Europe, he would name 6 US banks and in the US, he would name 6 European banks. The duped never bothered to check. The bankers who did check never did business with Madoff. In today's world, you should be very careful about physical gold, gold funds and hi-return sovereign bond funds. Anyone selling you these are very dangerous, indeed!

3. What to do with a fraudster after you've detected one? This depends on you. Remember a fraudster is a bit charming, so in the majority of meetings, you will end up paying. Remember nothing is for free and that deals that "have no risk" or offer an abnormal rate of return, or something for which you don't need to pay the full price either or both in terms of time or money, are simply "junk." One of the insanely funny things I learned while trading as an investment banker is that I couldn't trust my "boss" or his "boss" to tell me the truth about anything that affected my personal welfare. I learned to take statements such as "believe me" from my superiors to be the strongest sell signals! I recently experienced a very similar incidence of this sort of funny behaviour at a university. And when I use to employ people, I found they would dip their hands in the cookie jar. In governance theory, we call this the agency problem. The classic agency solution is to offer employees a stock option scheme! Laughable, no? Will a stock option scheme eradicate dishonesty, lies, cheating and stealing? I don't think so.

4. Best is to be vigilant. In Aikido, if someone had broken the code of conduct, eg, broken a promise to a Sensei, stolen from the dojo, lied in public etc., the punishment was quite amazing. The punishment wasn't a stripping of one's rank or being thrown out of the dojo or even a demotion. The gravest punishment was to be called before the senior teachers and for the teachers to "laugh." No fraudster wants to be laughed at. It means he or she cannot be taken seriously. Next time you come across a fraudster, try laughing. It usually is disconcerting enough to spill the beans.

Sunday, 28 August 2011

Friday, 26 August 2011

n-Financial Theology: Banks at Trimalchio's Feast and How to Hold Members of the US Fed Personally Liable For Misrepresentation under the 1913 federal Reserve Act

1. The CDS spread over libor tells us BARCLAYS is being adjudged worrisome amongst its peers:

Source: http://www.zerohedge.com/news/presenting-warren-archimedes-buffetts-amazing-24-hour-monster-bank-america-due-diligence-sessio

2. Yesterday, Warren Buffet after a day due diligence entered into a sweetheart deal with Bank of America. Remember how Warren saved Goldman Sachs back in 2008? The hoi polloi back then thought if Warren could do it then he was both heroic and patriotic. Now, his move on BAC may be interpreted not as a savvy trade but as one of those moves of a sick empire. My reference here is Trimalchio's Feast in Petronius' Satyricon. [By the way, the best modern translation of that end of Empire novel is Fellini's film rendition.] It's grating to read the management of BAC saying they need no capital and that Warren's capital injection therefore was unnecessary. Then why accept it in the first place? And why allow him such a gigantic upfront premium to get in? For my law and finance students, here's the disclosure document dated August 25, 2011: http://www.sec.gov/Archives/edgar/data/70858/000119312511232422/dex11.htm

For a more journalistic interpretation, see: http://www.bloomberg.com/news/2011-08-26/buffett-s-bofa-investment-is-latest-to-capitalize-on-wall-street-weakness.html

And of course, for a more sarcastic wit and invective which can inform your trading view, see zero hedge: http://www.zerohedge.com/news/presenting-warren-archimedes-buffetts-amazing-24-hour-monster-bank-america-due-diligence-sessio

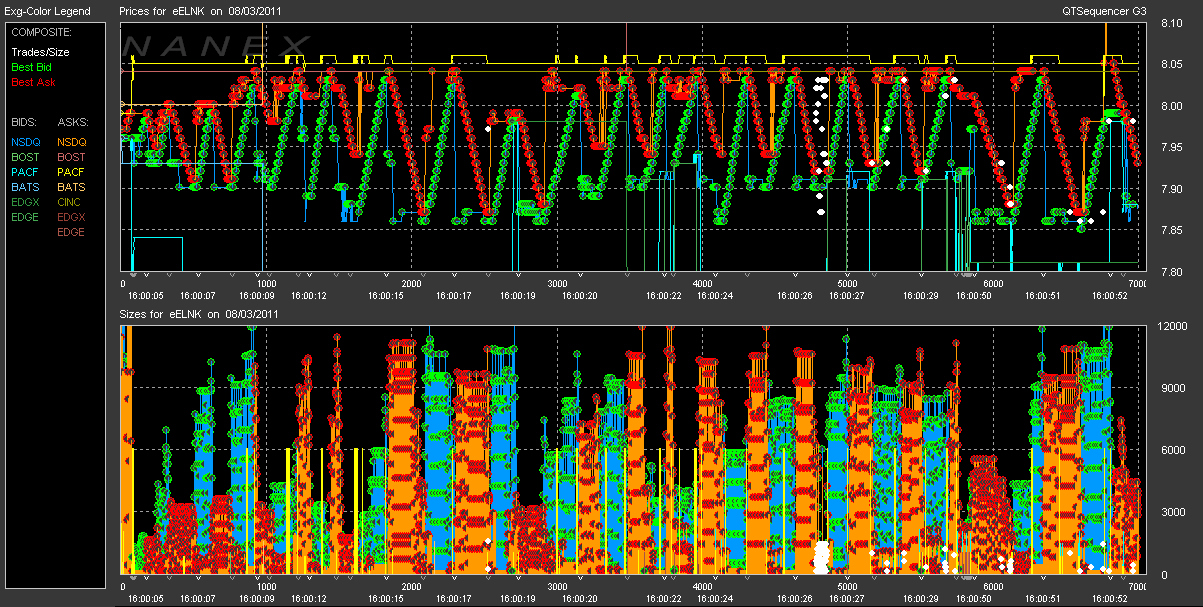

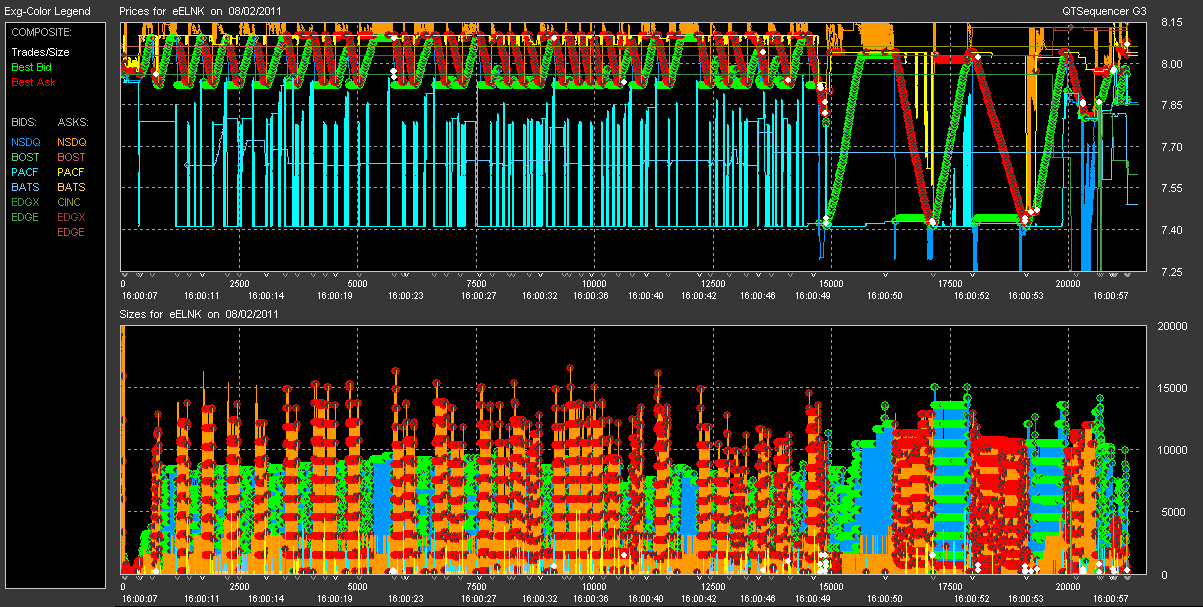

3. Two other "events" as in Badiou's Being and Event are worth mentioning today: (1) Greece has tapped its emergency loan facility which means really, really, this time we are just a hair away from either a bank run or amalgamation of banks or revolution based on bank-government fraud catching up to depositors who are still crazy enough to hold deposits and (2) Ben Bernanke's Jackson Hole speech which the Market is discounting a "no QE3". Even if he announces a QE3, it is largely irrelevant to the NON-HUMAN BEINGS, because the ALGOS built by 20-year olds have taken over. Look at Dell's 10,000 unhit bids yesterday! The Capital Markets - What use to be the crowning glory of free capitalism ideology has become totally dissociated from productive capital, merely serving as a distraction for the guests at Trimalchio's last dinner.

4. 1, 2 and 3 are data feeds to grand models which might be called EXISTENTIAL MODIFIERS. See for example: Bostrom's works on "existential risk": http://www.existential-risk.org/concept.pdf and The future of humanity: http://www.nickbostrom.com/papers/future.pdf.

There are also a number of complexity theorists seeing a strong correlation between food prices and riots and wars. Duh.

5. A much more interesting form of "for public activist research" would be to see whether the members of the US Fed could be held civilly liable for misrepresentations under Title XII, Ch 3, Subchap XVI, Sec 503. See: http://www.law.cornell.edu/uscode/12/usc_sec_12_00000503----000-.html

Source: http://www.zerohedge.com/news/presenting-warren-archimedes-buffetts-amazing-24-hour-monster-bank-america-due-diligence-sessio

2. Yesterday, Warren Buffet after a day due diligence entered into a sweetheart deal with Bank of America. Remember how Warren saved Goldman Sachs back in 2008? The hoi polloi back then thought if Warren could do it then he was both heroic and patriotic. Now, his move on BAC may be interpreted not as a savvy trade but as one of those moves of a sick empire. My reference here is Trimalchio's Feast in Petronius' Satyricon. [By the way, the best modern translation of that end of Empire novel is Fellini's film rendition.] It's grating to read the management of BAC saying they need no capital and that Warren's capital injection therefore was unnecessary. Then why accept it in the first place? And why allow him such a gigantic upfront premium to get in? For my law and finance students, here's the disclosure document dated August 25, 2011: http://www.sec.gov/Archives/edgar/data/70858/000119312511232422/dex11.htm

For a more journalistic interpretation, see: http://www.bloomberg.com/news/2011-08-26/buffett-s-bofa-investment-is-latest-to-capitalize-on-wall-street-weakness.html

And of course, for a more sarcastic wit and invective which can inform your trading view, see zero hedge: http://www.zerohedge.com/news/presenting-warren-archimedes-buffetts-amazing-24-hour-monster-bank-america-due-diligence-sessio

3. Two other "events" as in Badiou's Being and Event are worth mentioning today: (1) Greece has tapped its emergency loan facility which means really, really, this time we are just a hair away from either a bank run or amalgamation of banks or revolution based on bank-government fraud catching up to depositors who are still crazy enough to hold deposits and (2) Ben Bernanke's Jackson Hole speech which the Market is discounting a "no QE3". Even if he announces a QE3, it is largely irrelevant to the NON-HUMAN BEINGS, because the ALGOS built by 20-year olds have taken over. Look at Dell's 10,000 unhit bids yesterday! The Capital Markets - What use to be the crowning glory of free capitalism ideology has become totally dissociated from productive capital, merely serving as a distraction for the guests at Trimalchio's last dinner.

4. 1, 2 and 3 are data feeds to grand models which might be called EXISTENTIAL MODIFIERS. See for example: Bostrom's works on "existential risk": http://www.existential-risk.org/concept.pdf and The future of humanity: http://www.nickbostrom.com/papers/future.pdf.

There are also a number of complexity theorists seeing a strong correlation between food prices and riots and wars. Duh.

5. A much more interesting form of "for public activist research" would be to see whether the members of the US Fed could be held civilly liable for misrepresentations under Title XII, Ch 3, Subchap XVI, Sec 503. See: http://www.law.cornell.edu/uscode/12/usc_sec_12_00000503----000-.html

Monday, 22 August 2011

n-Financial Theology versus n-Financial Wars -- Vitae Summa Brevis

1. Since 99.99...% (practically all) of our moneyed transactions are based on debt, debt as a convention decreed into existence from nothing has become our reality. For the last great word on how we realise consciousness from the reality created by convention, see Nagarjuna's Mulamadhyamakakarika (Fundamental Verses of the Middle Way). Debt bondage is what made Buddha come back to this plane of existence to extinguish all the promises he had made in all of his previous incarnations, and only then, could he move on as genuinely liberated. Socrates the Enlightened Master of Western philosophy startled all those at his hemlock induced death, by rising one last time to say, "Crito, we owe a cock to Asclepius. Please don't forget to pay the debt." I always tell young people to pay off their mortgages early to achieve partial financial freedom. Note how Obama would have more and more people enslaved by delaying their payments due. I'm sure he thinks he is doing the right thing which means I believe he is delusional but really what he is advocating is MORAL BANKRUPTCY.

2. Now bondage has a bit more impersonal and generalised meaning in this BOND-AGE. Fiat money is no more than the desires of civilisation through the BELIEF in writing on paper and electronic phosphorescence. It is both the greatest convenience since it is relatively costless and the greatest risk, since if it fails to be believed, it is worthless. Thus, money in the sense of fiat currency and as objects of belief may perhaps best be studied as a subject of SOCIAL ANTHROPOLOGY and/or as a matter of THEOLOGY. Many (most? all?) of the doctrines espoused by politicians, central bankers, investment bankers (i.e., high priests of the swirling academic neighbourhood gangs/thugs who advocate "war" for socio-economic salvation eg PAUL KRUGMAN or reparations of busted business cycles with moderate inflation to signal Americans out of DEPRESSION, such as BEN BERNANKE) cannot even begin to conceive of a world without fiat currency. Why? Because think of what would happen to the world if $600 trillion of derivatives based on fiats needed to be unwound. Maybe nothing returns. After all the equation is: Inconceivable Amount x Inconceivable Unwind = Inconceivable Whatever.

3. What's next? Personally, I keep on bugging my wife for us to buy a small farm with its own well. In any case, I liquidated all investment exposures to fiat back in 2006. There're Irish farmlands plus farm houses for about 70k EURO. "vitae summa brevis spem nos vetat incohare longam" (The total of life's brevity forbids us clinging to long-off hope). Horace, Odes, I.4

2. Now bondage has a bit more impersonal and generalised meaning in this BOND-AGE. Fiat money is no more than the desires of civilisation through the BELIEF in writing on paper and electronic phosphorescence. It is both the greatest convenience since it is relatively costless and the greatest risk, since if it fails to be believed, it is worthless. Thus, money in the sense of fiat currency and as objects of belief may perhaps best be studied as a subject of SOCIAL ANTHROPOLOGY and/or as a matter of THEOLOGY. Many (most? all?) of the doctrines espoused by politicians, central bankers, investment bankers (i.e., high priests of the swirling academic neighbourhood gangs/thugs who advocate "war" for socio-economic salvation eg PAUL KRUGMAN or reparations of busted business cycles with moderate inflation to signal Americans out of DEPRESSION, such as BEN BERNANKE) cannot even begin to conceive of a world without fiat currency. Why? Because think of what would happen to the world if $600 trillion of derivatives based on fiats needed to be unwound. Maybe nothing returns. After all the equation is: Inconceivable Amount x Inconceivable Unwind = Inconceivable Whatever.

3. What's next? Personally, I keep on bugging my wife for us to buy a small farm with its own well. In any case, I liquidated all investment exposures to fiat back in 2006. There're Irish farmlands plus farm houses for about 70k EURO. "vitae summa brevis spem nos vetat incohare longam" (The total of life's brevity forbids us clinging to long-off hope). Horace, Odes, I.4

Saturday, 20 August 2011

n-Riots, Spinoza, Cannibalism: Not Prison but Non-PC Love

1. Damasio the neuro-physician in his book, Looking For Spinoza, describes a scene in Spinoza's rather cloistered life where on a beautiful day in the freest of free thinking Holland, an angry mob captured a city official and not only killed him, but ate him.

2. Spinoza hardly ever left his small room and many of the finest minds in Europe would visit him. He had worked out an ethical philosophy which is probably of rank with Aristotle's and according to Damasio, Spinoza's description of human feelings are consistently accurate with current neurophysiological research.

3. But I'm wondering what Spinoza would have made of the London riots in August 2011? Would he have been surprised? Back in Spinoza's time, Holland had just experienced a terrible economic down-turn and people were literally starving. But in London at the time of the riots, the young people were looting shops for kit and goods they could sell on the web, the street or to friends. The kids were "bragging" of their loot as if they were trophies.

4. This reminds me of some anthropological explanations of head-hunting and cannibalism. I've never met a hunt-hunter, but I did meet a student at Oxford who claims that his great-grand-mother told him that "white meat is a bit sweet like succulent pig." Hmm. And I devoured (pun intended) a number of ethnographies on tribes in Papua New Guinea. The explanations for head-hunting differed radically but all revolved around (1) some liminal rite determining a division between in- and out-group where the actor would need to enact or participate in particular prescribed behaviours, and (2) some rite of incorporation where the actor upon completion of said prescribed acts, would then enjoy certain new "rights," "privileges," and "immunities." By performing the prescribed acts, the actor moved from outside to the inside group. As you can imagine, most of these ritualised acts appeared rather dangerous.

5. There are some commentators saying that riots can be explained in terms of a "gangsta culture." I think that this would be at best a very loose affiliation--much like saying one's actions on a Sunday football pitch comes from the fervour of belonging to a particular football team, and not the types of ritualisation that's normally required to become a member of an in-group. But then again, some football parents do bare their teeth!

6. Bottom-line: Will London have more riots? Probably, yes. What can we do to help lessen the risk of future riots? Lock children up until they are 30? Well, there are lots of studies showing that prisons are the best breeding grounds for recidivism. So, no. Locking up children and youths is just stupid in the longer term but convenient to score political points in the short term.

7. A bit of non-PC love is in order from the mum or pop. Oh yes, one question you can always teach children is to ask before taking anything that isn't theirs. If the child doesn't understand this concept then unfortunately you simply have a cannibal on your hands! Sarc/off.

2. Spinoza hardly ever left his small room and many of the finest minds in Europe would visit him. He had worked out an ethical philosophy which is probably of rank with Aristotle's and according to Damasio, Spinoza's description of human feelings are consistently accurate with current neurophysiological research.

3. But I'm wondering what Spinoza would have made of the London riots in August 2011? Would he have been surprised? Back in Spinoza's time, Holland had just experienced a terrible economic down-turn and people were literally starving. But in London at the time of the riots, the young people were looting shops for kit and goods they could sell on the web, the street or to friends. The kids were "bragging" of their loot as if they were trophies.

4. This reminds me of some anthropological explanations of head-hunting and cannibalism. I've never met a hunt-hunter, but I did meet a student at Oxford who claims that his great-grand-mother told him that "white meat is a bit sweet like succulent pig." Hmm. And I devoured (pun intended) a number of ethnographies on tribes in Papua New Guinea. The explanations for head-hunting differed radically but all revolved around (1) some liminal rite determining a division between in- and out-group where the actor would need to enact or participate in particular prescribed behaviours, and (2) some rite of incorporation where the actor upon completion of said prescribed acts, would then enjoy certain new "rights," "privileges," and "immunities." By performing the prescribed acts, the actor moved from outside to the inside group. As you can imagine, most of these ritualised acts appeared rather dangerous.

5. There are some commentators saying that riots can be explained in terms of a "gangsta culture." I think that this would be at best a very loose affiliation--much like saying one's actions on a Sunday football pitch comes from the fervour of belonging to a particular football team, and not the types of ritualisation that's normally required to become a member of an in-group. But then again, some football parents do bare their teeth!

6. Bottom-line: Will London have more riots? Probably, yes. What can we do to help lessen the risk of future riots? Lock children up until they are 30? Well, there are lots of studies showing that prisons are the best breeding grounds for recidivism. So, no. Locking up children and youths is just stupid in the longer term but convenient to score political points in the short term.

7. A bit of non-PC love is in order from the mum or pop. Oh yes, one question you can always teach children is to ask before taking anything that isn't theirs. If the child doesn't understand this concept then unfortunately you simply have a cannibal on your hands! Sarc/off.

N-Financial Theology: The Demonization of the US Fed versus Its Benevolent Deontology

1. If you read the conspiracist literature just for fun or like me, because I find fairy tales and imaginary literature compelling in the way William Blake called such works of poetry as "images of the truth" and here we mean, the truth of the interiority of our minds, the latest blameworthy theme bandied about is the root and handmaiden of evil in the Evil Empire is the US Fed. The media savvy and very popular Aaron Russo released a film documentary on America: From Freedom to Fascism in 2007 which helped the Presidential campaign of Ron Paul, who is again currently running for the Republican nomination. One of Ron Paul's campaign promises is to dismantle the Fed.

2. I have to admit that Russo is a compelling story-teller and rhetorician. See: http://v11.lscache6.googlevideo.com/videoplayback?id=3594925e2e858fa6&itag=7&begin=0&ratebypass=yes&title=Historic+Interview+with+Aaron+Russo,+Fighting+Cancer+and+the+New+World+Order&ip=0.0.0.0&ipbits=0&expire=1313850432&sparams=ip,ipbits,expire,id,itag,ratebypass,title&signature=7B243C2E27F34944EE3298FD66CACD34C29D8596.3E0C3DA5D5F80AD17977D45A7E440379DB83B4B5&key=ck1

And I'm always open to hearing alternative universe views on how the money-banking system SHOULD work as Ron Paul continuously advocates his libertarian (though unquantifiably testable) views. But one might note that although the US Fed operates as a quasi-private institution (the US President appoints council members and sets salary levels), it does make a profit and pays most of it back to the US Treasury in the form of tax. In March 2010, of its $82 billion profit, it paid $79 billion to the Treasury.

3. I don't believe the US Fed is part of an evil cabal or a servant of any particular "bankster" group. It simply has a very difficult job of managing "monetary" policy with very blunt tools. When you think about their powers for even a few minutes, you may see that as a bank all they can do is lend or borrow and pay most of their profits back to the Treasury. They don't directly affect fiscal policy and their attempt to stimulate the economy during recession is again very limited. To say we have to kill the central bank because they are the root of evil ignores the bank's rather benevolent deontology.

4. Basically, the US Fed gives the government SOME TIME to sort out CURRENT messes over a LONGER period of time. This cannot be easily replaced, and without it, many of the fruits of a complex and FREE micro-economy cannot even be realised on a day by day basis without this TIME-TRANSFER-OF-RISK function. The central bank tries to ensure the smooth operation of the money-pump in complex societies. It might be thought of as the life-blood system to Adam Smith's "invisible hand."

2. I have to admit that Russo is a compelling story-teller and rhetorician. See: http://v11.lscache6.googlevideo.com/videoplayback?id=3594925e2e858fa6&itag=7&begin=0&ratebypass=yes&title=Historic+Interview+with+Aaron+Russo,+Fighting+Cancer+and+the+New+World+Order&ip=0.0.0.0&ipbits=0&expire=1313850432&sparams=ip,ipbits,expire,id,itag,ratebypass,title&signature=7B243C2E27F34944EE3298FD66CACD34C29D8596.3E0C3DA5D5F80AD17977D45A7E440379DB83B4B5&key=ck1

And I'm always open to hearing alternative universe views on how the money-banking system SHOULD work as Ron Paul continuously advocates his libertarian (though unquantifiably testable) views. But one might note that although the US Fed operates as a quasi-private institution (the US President appoints council members and sets salary levels), it does make a profit and pays most of it back to the US Treasury in the form of tax. In March 2010, of its $82 billion profit, it paid $79 billion to the Treasury.

3. I don't believe the US Fed is part of an evil cabal or a servant of any particular "bankster" group. It simply has a very difficult job of managing "monetary" policy with very blunt tools. When you think about their powers for even a few minutes, you may see that as a bank all they can do is lend or borrow and pay most of their profits back to the Treasury. They don't directly affect fiscal policy and their attempt to stimulate the economy during recession is again very limited. To say we have to kill the central bank because they are the root of evil ignores the bank's rather benevolent deontology.

4. Basically, the US Fed gives the government SOME TIME to sort out CURRENT messes over a LONGER period of time. This cannot be easily replaced, and without it, many of the fruits of a complex and FREE micro-economy cannot even be realised on a day by day basis without this TIME-TRANSFER-OF-RISK function. The central bank tries to ensure the smooth operation of the money-pump in complex societies. It might be thought of as the life-blood system to Adam Smith's "invisible hand."

Friday, 19 August 2011

n-Euro German Swiss Risk Bets--Can we save ourselves from our children's riots?

Source: http://www.zerohedge.com/news/europes-last-resort-very-much-doomed-maginot-line-part-deux

2. You don't need to know a whole lot about European history to understand how vain European projects are. As the financial markets continue their "risk off" trend with rumours of illiquidity now billowing not from the Tragic Greek Chorus but from Switzerland which has taken $200million from the US Fed Swap Line, which may seem infinitely tiny in the scheme of things, but which can be infinitely levered, we have one of four trap doors to enter: (1) the SNP (central bank of Switzerland) genuinely needs US Dollars because even though it can print CHF, it doesn't want any more EURO exposure, and would rather take USD appreciation risk, which maybe means, THEY KNOW THE FED is going to do a QE3; (2) as Tyler Durden believes, the liquidity lines in Europe are in big trouble, and the SNP is just acting as front cover for some European bank(s) which is/are now in acta mortis; or as my wife (no expert in finance, but what a brain) thinks (3) this is a HEAD-FAKE by the SNP to scare off the already terrified Euro-holders from buying any more Swissies. Of course, if the $200mill purchase by the SNP is not a head-fake and they are not try to butress a European bank or banks, then the last possible alternative is (4) one of the two big Swiss banks is in trouble. At this point, if you decide to take a bet, you have a 1 in 8 chance of getting it right. That is, take the 4 choices as equi-probable and (4) again being equi-probable. What's clear is that all choices in the above bad for market sentiment.

3. As our children grow up and realise what we with our banking and political systems have done--basically lie, cover-up, and lie again--they are going to get pissed off. IF WE START TELLING THEM THE HONEST TRUTH NOW, THEY might (pretty please) SPARE US.

Thursday, 18 August 2011

Does The Policy of Raising University Tuition Fees in England Meet the Aristotelian Criteria of the Social Good?

1. Aristotle gave us rather specific NON-FINANCIAL-ECONOMIC definitions of the good or virtue. Via St. Thomas Aquinas' interpretation of Aristotelian philosophy in his Summa Theologica, a contract is good if it satisfies one of three virtues: (1) PROMISE-KEEPING which is related to reason, will and ordering human relations such that the promisor is bound to the limits of his intention to the promisee, (2) COMMUTATIVE JUSTICE, which can be either GEOMETRIC which means that distribution is in accordance with hierarchical groupings of society or ARITHMETIC, which means that as a matter of bilateral exchange adjustments can be made to achieve a relatively fair balance of distribution between the two parties; and (3) LIBERALIITY, that the exchange is materially unilateral (uni-directional) with no expectation of return and therefore, no reciprocal obligation on the receiving party. Importantly, much of what we would consider is the good of a contract is bound up with its ends. And having determined its ends, we can work backwards to determine the good of its means. Please don't rely on my word on what St Thomas says about these matters or what I think Aristotle might have said. I'd recommend strongly that you see for yourselves.

2. In England, the new Tory-led-co-opted-Liberal coalition with its tortured sense of quack-economics, has decided to raise tuition fees for university students, giving them the "right" (notice the torturous use of art) to pay for the "duty" of universities providing education for value. The new limit is £9k per year from an old limit of say £3.5k. Students who take advantage of their new rights will be required to start paying back only when they start earning a certain level of income, and there are a number of ways which a university may mitigate the higher tuition fees. For example, Universities can act like good used car salesmen and offer cash rebates to students. Reminds me of a rather ribald ad I heard in the US, "Bring your ass in and get a clean wiper!" It's easy to see that the market value equilibrium will be just the (aggregate average nominal price of the advertised less the discount cash offer) divided by the (discount rate for the average number of years for collection). So, this means, Universities offering the BIGGEST DISCOUNTS will get the most students, so for these FACTORY MODEL STACK EM HIGH universities, the decision will simply be based on a commoditised price (elastic demand curve). For other world-class brand named institutions, no discounts need be provided, and in fact, they could charge a lot more because of their perceived inelastic demand. This means we still have at least a two-tier or three-tier university educational system. The widest spectrum is de facto, from institutions gaining little or no return (high discount providers) to premium brands ("I paid a million bucks for my Patek Philippe degree and it doesn't talk back.") Permit me to give you an example from the unregulated postgraduate degree market.

3. London Business School holds the world's top ranking for its MBA and its Masters in Finance courses. Guess how many applications it receives each year for 2,000 places. About 250,000! If it could sell its database of rejections it could probably make £15 million per year. That's approximately the same gross amount that my University's business school makes for all its undergrad programmes. And these two Universities are only a 5 minute walk from each other.

4. Coming back to Aristotle. Is the tuition fee rise a good thing? In terms of promise-keeping, no. The broken promises of Nick Clegg Liberals to not raise tuition fees make them laughing stock liars and totally untrustworthy. Imagine Nick Clegg saying something like, "I promise NOT to bomb Syria," -- there'd be a war in 24 minutes.

5. How about under commutative justice? I'd argue that the tuition raise does nothing for geometric or arithmetic justice, and if anything makes injustice worse on both counts. For geometric or social level of distribution, students coming from lower income or deprived backgrounds will perceive a relatively higher risk in paying for an education, and therefore, are more likely to not participate, while students from relatively higher income brackets will feel no difference since their rich mums and dads will pay for their way anyway. So, on the geometric measure of justice, the tuition rise fails. With regard to the arithmetic, there is a close argument that the student will now be more discriminating, and therefore, move towards courses which offer the value which the student desires. But again, for a relatively poor student, he or she may still be priced out of the market and therefore, be unable to practically participate in "arithmetical justice."

6. Finally, how about liberality? How about it? Well, frankly, no. No freebies to University students.

7. There you have it. Under all three Aristotelian-Aquinian criteria for adjudging the moral goodness of the tuition fee hike rule, the rule takes a hike.

2. In England, the new Tory-led-co-opted-Liberal coalition with its tortured sense of quack-economics, has decided to raise tuition fees for university students, giving them the "right" (notice the torturous use of art) to pay for the "duty" of universities providing education for value. The new limit is £9k per year from an old limit of say £3.5k. Students who take advantage of their new rights will be required to start paying back only when they start earning a certain level of income, and there are a number of ways which a university may mitigate the higher tuition fees. For example, Universities can act like good used car salesmen and offer cash rebates to students. Reminds me of a rather ribald ad I heard in the US, "Bring your ass in and get a clean wiper!" It's easy to see that the market value equilibrium will be just the (aggregate average nominal price of the advertised less the discount cash offer) divided by the (discount rate for the average number of years for collection). So, this means, Universities offering the BIGGEST DISCOUNTS will get the most students, so for these FACTORY MODEL STACK EM HIGH universities, the decision will simply be based on a commoditised price (elastic demand curve). For other world-class brand named institutions, no discounts need be provided, and in fact, they could charge a lot more because of their perceived inelastic demand. This means we still have at least a two-tier or three-tier university educational system. The widest spectrum is de facto, from institutions gaining little or no return (high discount providers) to premium brands ("I paid a million bucks for my Patek Philippe degree and it doesn't talk back.") Permit me to give you an example from the unregulated postgraduate degree market.

3. London Business School holds the world's top ranking for its MBA and its Masters in Finance courses. Guess how many applications it receives each year for 2,000 places. About 250,000! If it could sell its database of rejections it could probably make £15 million per year. That's approximately the same gross amount that my University's business school makes for all its undergrad programmes. And these two Universities are only a 5 minute walk from each other.

4. Coming back to Aristotle. Is the tuition fee rise a good thing? In terms of promise-keeping, no. The broken promises of Nick Clegg Liberals to not raise tuition fees make them laughing stock liars and totally untrustworthy. Imagine Nick Clegg saying something like, "I promise NOT to bomb Syria," -- there'd be a war in 24 minutes.

5. How about under commutative justice? I'd argue that the tuition raise does nothing for geometric or arithmetic justice, and if anything makes injustice worse on both counts. For geometric or social level of distribution, students coming from lower income or deprived backgrounds will perceive a relatively higher risk in paying for an education, and therefore, are more likely to not participate, while students from relatively higher income brackets will feel no difference since their rich mums and dads will pay for their way anyway. So, on the geometric measure of justice, the tuition rise fails. With regard to the arithmetic, there is a close argument that the student will now be more discriminating, and therefore, move towards courses which offer the value which the student desires. But again, for a relatively poor student, he or she may still be priced out of the market and therefore, be unable to practically participate in "arithmetical justice."

6. Finally, how about liberality? How about it? Well, frankly, no. No freebies to University students.

7. There you have it. Under all three Aristotelian-Aquinian criteria for adjudging the moral goodness of the tuition fee hike rule, the rule takes a hike.

Wednesday, 17 August 2011

n-Financial Theology: Which is better from a philosophical perspective, Islamic finance or conventional finance?

1. I know this is a riduculous question, vague and on its face, full of false dichotomies. Nevertheless, there is something straightforward that I have in mind which (1) illustrates the use of category theory as a mode for understanding general concepts in law and finance and (2) to comment and critique what appears to be the morally vacuous and easily reprehensible space of financial derivatives contracts. I will skip (1) for an another day and delve into (2).

2. In brief, my argument, borrowing from James Gorley's (1991) The Philosophical Origins of Modern Contract Doctrine, is that the moral tethers to the Aristotelian-cum-Aquinaian philosophical conceptions that contract law had built from the 13th (Aquinas proper) to the 16th and 17th centuries (the Spanish school) were loosened by the Enlightenment and finally, severed by 18th and 19th century northern European theorists, leaving the corpus of what we know as common law rules of contract (the doctrinal black letter laws)-- offer and acceptance, duress, consent and so on--de-linked from any fundamental moral conception of the Good (as per Aristotle-Aquinas)--and consequently, throughout the second half of the 20th century this 'moral vacuum' in the justification of contracts has been filled by quack-economic theories which demonstrably do not work in the real world and moreover, the morally-de-linked financial contracts per se have contributed significantly to the abuses of chrematistics that Aristotle warned us of in his Politics 2,400 years ago.

3. It would take me a couple thousand words to unpack the paragraph above, but for this blog, let's just assume I could persuade you that this argument is plausible. How does the title to the blog fit now? Well, one way is to say that in contrast to the morally-empty chrematistic financial contracts of Wall St bankers, Islamic finance contracts have not lost their "soul", that is, their philosophical-moral foundations. I can hear a chorus of objections: (1) that financial contracts must be decided on a flexible commercial basis to meet the needs of a dynamic gobal industry and (2) who cares about ancient philosophers anyway--aren't they all dead and Greek, and as we see today, completely untrustworthy? In quick reposte: the argument in (1) is circular and the argument in (2) is ad hominem.

4. The serious point I want to make is that just maybe what Aristotle warned us about chrematistics is reaching a global limit of Tom-foolery. Are rating agencies responsible to tell us the "truth" about the wherewithal of a legal entity to make good its financial obligations? And what does it mean to "rate" a sovereign? Just because we can make leveraged financial instruments, are we to believe we are no longer responsible for their being and becoming in the real world? Ask an investment banker what is the most moral and least moral financial instruments in his arsenal. Absolutely no conception. But ask an Islamic financier the same question, and off he goes, giving you a very nuanced argument based on general moral principles. They may not all come to the same conclusion, but there is a process by which these conclusions are reached. In the secular finance world, where no justification is given except an incremental return, the entire enterprise becomes an empty ritual. In this secular world, where "hedge arbitrage" and "regulatory arbitrage" are accepted as goods-in-themselves, virtues are segregated from action. And like Humpty-Dumpty, we can't put him back together.

2. In brief, my argument, borrowing from James Gorley's (1991) The Philosophical Origins of Modern Contract Doctrine, is that the moral tethers to the Aristotelian-cum-Aquinaian philosophical conceptions that contract law had built from the 13th (Aquinas proper) to the 16th and 17th centuries (the Spanish school) were loosened by the Enlightenment and finally, severed by 18th and 19th century northern European theorists, leaving the corpus of what we know as common law rules of contract (the doctrinal black letter laws)-- offer and acceptance, duress, consent and so on--de-linked from any fundamental moral conception of the Good (as per Aristotle-Aquinas)--and consequently, throughout the second half of the 20th century this 'moral vacuum' in the justification of contracts has been filled by quack-economic theories which demonstrably do not work in the real world and moreover, the morally-de-linked financial contracts per se have contributed significantly to the abuses of chrematistics that Aristotle warned us of in his Politics 2,400 years ago.

3. It would take me a couple thousand words to unpack the paragraph above, but for this blog, let's just assume I could persuade you that this argument is plausible. How does the title to the blog fit now? Well, one way is to say that in contrast to the morally-empty chrematistic financial contracts of Wall St bankers, Islamic finance contracts have not lost their "soul", that is, their philosophical-moral foundations. I can hear a chorus of objections: (1) that financial contracts must be decided on a flexible commercial basis to meet the needs of a dynamic gobal industry and (2) who cares about ancient philosophers anyway--aren't they all dead and Greek, and as we see today, completely untrustworthy? In quick reposte: the argument in (1) is circular and the argument in (2) is ad hominem.

4. The serious point I want to make is that just maybe what Aristotle warned us about chrematistics is reaching a global limit of Tom-foolery. Are rating agencies responsible to tell us the "truth" about the wherewithal of a legal entity to make good its financial obligations? And what does it mean to "rate" a sovereign? Just because we can make leveraged financial instruments, are we to believe we are no longer responsible for their being and becoming in the real world? Ask an investment banker what is the most moral and least moral financial instruments in his arsenal. Absolutely no conception. But ask an Islamic financier the same question, and off he goes, giving you a very nuanced argument based on general moral principles. They may not all come to the same conclusion, but there is a process by which these conclusions are reached. In the secular finance world, where no justification is given except an incremental return, the entire enterprise becomes an empty ritual. In this secular world, where "hedge arbitrage" and "regulatory arbitrage" are accepted as goods-in-themselves, virtues are segregated from action. And like Humpty-Dumpty, we can't put him back together.

Tuesday, 16 August 2011

Zenkyoren Lesson: Why We Should Not Make Obviously Bad Decisions

1. Back in the late 1980's while working for Nomura Securities in London, I use to make calls to large institutional clients. One was Zenkyoren. If you've heard about them then you have very specialised knowledge. The manager in charge, Kobayashi-San was always genuinely kind to me, serving me tea and telling me remarkable stories about Zenkyoren. It was the agricultural insurance fund. When I first glanced at its brochure, I told Kobayasi-San that there was a typo. He said, "Where?" "Here, the reported assets have too many ZEROS." He laughed and said, "No, Tanega-san, that's the correct number of zeros." "But Kobayasi-San, that would mean you are the largest fund in the world, by far!" He simply smiled, "Really?" "Yes, I really mean it. HOW IS IT POSSIBLE?"

2. Kobayashi-San then pointed to a picture on the wall. "Tanega-San, please look at this picture. It is our board of directors. Do you notice anything strange?" I looked carefully. I saw a group of about 20 old men and Kobayashi-San standing in the middle with his charming smile. "Just old men," I said. He laughed and said, "Look at the old men's hands. Do you see anything?". I was looking for something IN their hands and saw nothing. "No, I can't see anything, I said. "Look, how LARGE their hands are," he said. And then it hit me. These board members were FARMERS.

3. Kobayshi explained how the farmers in Japan organised themselves, how they saved IMMENSE money to support their retirees, building IMMENSE first class facilities like physical fitness stadiums, spa resorts, and care centres and how this particular fund was meant to preserve their future for at least seven generations--150 years or more. Really?

4. We then spoke about rates of return. I asked, "Kobayshi-San, why are you buying long term assets at what you know will bring you negative return?" To set this in context, this was 1988 and Japanese brokers were stuffing Japanese institutions with crap paper and on any reasonable estimation the the long term funding gap showed that these institutions would be losing or paying 2% per year for the privilege! His answer betrays the "giri" values of the people. "Tanega-San, this is something we must do for everyone." "But Kobayasi-San, you can't do this forever. You will run out of money." "Not for a long time, Tanega-San."

5. Really? Dear Reader, just because governments have printing presses and can roll over their national debts at near-zero interest rates does NOT MEAN that said governments will be able to fool anybody in the markets for any appreciable time. The US and Europe have STRUCTURAL problems that cannot be solved without a re-setting of debts. Expect only fool's rallies until the debts come under control.

2. Kobayashi-San then pointed to a picture on the wall. "Tanega-San, please look at this picture. It is our board of directors. Do you notice anything strange?" I looked carefully. I saw a group of about 20 old men and Kobayashi-San standing in the middle with his charming smile. "Just old men," I said. He laughed and said, "Look at the old men's hands. Do you see anything?". I was looking for something IN their hands and saw nothing. "No, I can't see anything, I said. "Look, how LARGE their hands are," he said. And then it hit me. These board members were FARMERS.

3. Kobayshi explained how the farmers in Japan organised themselves, how they saved IMMENSE money to support their retirees, building IMMENSE first class facilities like physical fitness stadiums, spa resorts, and care centres and how this particular fund was meant to preserve their future for at least seven generations--150 years or more. Really?

4. We then spoke about rates of return. I asked, "Kobayshi-San, why are you buying long term assets at what you know will bring you negative return?" To set this in context, this was 1988 and Japanese brokers were stuffing Japanese institutions with crap paper and on any reasonable estimation the the long term funding gap showed that these institutions would be losing or paying 2% per year for the privilege! His answer betrays the "giri" values of the people. "Tanega-San, this is something we must do for everyone." "But Kobayasi-San, you can't do this forever. You will run out of money." "Not for a long time, Tanega-San."

5. Really? Dear Reader, just because governments have printing presses and can roll over their national debts at near-zero interest rates does NOT MEAN that said governments will be able to fool anybody in the markets for any appreciable time. The US and Europe have STRUCTURAL problems that cannot be solved without a re-setting of debts. Expect only fool's rallies until the debts come under control.

Friday, 12 August 2011

n-JOKES: New Proposed Master of Laws Entrance Exam Tests English Comprehension and Humour

1. Major Premise of English Society: It is impossible to understand proper English without a strong sense of irony. For witticisms that bring a smile: see, http://www.ibk-lawyers.com/quotable.php

2. I'm tempted to use these sorts of quotations as new oral entry tests for applicants to my Master of Laws course. Three quotations will be read by the applicant. If the applicant does not laugh or smile upon reading each, the applicant will be denied entry for either a lack of English comprehension or a lack of humour. Examples follow:

3. "Quite apart from the judicial qualities of that learned judge, who was not at all prone to aberration, I am perfectly placed to repel any suggestion that advocacy could conceivably have accounted for that result, since I was leading counsel for the applicant."

Bokhary JA in chambers in The Queen v Oscar Li Ka To, on Cons VP grant of bail pending appeal in R v Tam Chung-sing.

4. "A bank's failure may, by force of rumour and suspicion, undermine other banks, perhaps very rapidly — Fama, malum qua non aliud velocius ullum — but it will not always do so."

Laws LJ in SRM Global Master Fund LP & Ors v The Commissioners of Her Majesty's Treasury (28 July 2009. [OK, this isn't funny but it is on point for the current banking crisis and how rioters in London are spreading their stories.]

5. "I questioned their parentage when they praised my virility..." Denis Healey, when asked if a shouting match on the floor of the Commons involved shouts of "bastards" and "f***er"

Thursday, 11 August 2011

n-Financial Wars: Ban Short Selling and Guess What Happens?

1. On Thursday, August 11, 2011, the government authorities of France, Belgium, Itay and Spain announced a short selling ban. See: http://www.ft.com/cms/s/0/9a55839a-c42d-11e0-ad9a-00144feabdc0.html#axzz1UjiDK0Zt

2. Just how smart is that? Zerohedge provides a succinct price comparison to the US short selling ban of Sep 19, 2008:

The short selling ban led to a 48% drop in less than a month.

Source: http://www.zerohedge.com/news/here-what-happened-when-sec-banned-shorting-financial-companies-2008

3. Anyone writing a short thesis on short selling (triple alliteration intended) must read the most Quack-Filled regulatory letter that rivals the pure shoot-myself-in-the-foot regulations of Sarbanes-Oxley and Dodd-Frank, called the "SEC Short Selling Ban" of September 19, 2008. See: http://www.sec.gov/news/press/2008/2008-211.htm

4. An important analysis of this ban that politely demolished the pro-ban arguments was conducted by the US SEC itself (!) (Dec 16, 2008) which stated that "our results ...are inconsistent with the notion that, on a regular basis, episodes of extreme negative returns are the result of short selling." See, http://www.sec.gov/comments/s7-08-09/s70809-369.pdf.

5. The outcome of (3) and (4) above is the SEC Short Sale Circuit Breaker Rule, see: http://www.sec.gov/rules/final/2010/34-61595.pdf, adopted Feb 26, 2010, which at 334 pages is a bargain and unlikely to have been read by anyone.

2. Just how smart is that? Zerohedge provides a succinct price comparison to the US short selling ban of Sep 19, 2008:

The short selling ban led to a 48% drop in less than a month.

Source: http://www.zerohedge.com/news/here-what-happened-when-sec-banned-shorting-financial-companies-2008

3. Anyone writing a short thesis on short selling (triple alliteration intended) must read the most Quack-Filled regulatory letter that rivals the pure shoot-myself-in-the-foot regulations of Sarbanes-Oxley and Dodd-Frank, called the "SEC Short Selling Ban" of September 19, 2008. See: http://www.sec.gov/news/press/2008/2008-211.htm

4. An important analysis of this ban that politely demolished the pro-ban arguments was conducted by the US SEC itself (!) (Dec 16, 2008) which stated that "our results ...are inconsistent with the notion that, on a regular basis, episodes of extreme negative returns are the result of short selling." See, http://www.sec.gov/comments/s7-08-09/s70809-369.pdf.

5. The outcome of (3) and (4) above is the SEC Short Sale Circuit Breaker Rule, see: http://www.sec.gov/rules/final/2010/34-61595.pdf, adopted Feb 26, 2010, which at 334 pages is a bargain and unlikely to have been read by anyone.

Recognising the Subtle of Boom-Bust Cycles -> Kondratiev, Ramachandran & Brunswik

1. Just in case you are wondering whether there is any theory available that might be better than astrology or macro-economics that might be able to help you prepare for the immediate and long term future, then you may want to investigate theories which have the form of PERMUTATION SYMMETRIES. These are theories and models that have a cyclic or ring structure. Think of Oedipus Rex, and the logic of tightly bound fate which causally folds back on itself.

An example of this sort of cyclic theory is Kondratiev. For good summation with links, see: http://en.wikipedia.org/wiki/Kondratiev_wave

Source: http://northcoastinvestmentresearch.wordpress.com/2009/02/02/the-kondratieff-cycle/

2. Whether traders, government regulators and market pundits like it or not, markets are bound by bilateral, translational and rotational symmetries at every discrete level of transaction. That is, from the level of a one to one party exchange, to the level of large movements of funds, goods, intangibles, across borders and recorded on electronic screens. Are markets suffused with these basic symmetries or are we projecting these symmetries onto what are actually random events of the markets? Epistemologically, the limit of pattern recognition is probably fixed at the neuronal level. [See, research on "mirror neurones"--Ramachandran's "A Tell-Tell Brain" (2011) is a good place to start. My 17 year old son is writing a philosophy paper on mirror neurones and the quantum brain hypothesis, and he tells me Ramachandran is quite readable.]

3. Is it possible that those who are able to read the markets well aren't just outliers on a normal distribution, but "wired" with a particular perceptual talent. My investigations in behavioural finance led me to a tragic-hero character named Brunswik of the University of California, Berkeley, who originated pyscho-metric testing for employment back in the 1920's and who created an amazing training model for enhancing pattern-recognition, which is used to this day, for example, to train up radar engineers to make split-second decisions relating to identifying "friend or foe" fighters in hundreds of milliseconds. One of his models which i really admire is called, "Brunswik Lens Symmetry" and is a classic in pedagogical methods. I wrote a rather lame 100 question do-it-yourself-Brunswik-Lens-Symmetry test 5 years ago which I've withheld from publication. Spooky thing is that it is fairly good at predicting the character of potential employees. Anyway, Brunswik was a tragic-hero, however, because he and his wife ended their lives together in a double suicide. His lecturing style was said to be rigorous, incorporating JS Mill, critiquing the Austrian School, and forming testable social algorithms whenever he could. The reason his stuff isn't really out in the open is because of the mathematics he used. Too bad. I believe his stuff really works and could be incorporated in say training stock market operators and machines in recognising certain types of market signals.

Source: http://psycnet.apa.org/index.cfm?fa=buy.optionToBuy&id=2007-10421-008

An example of this sort of cyclic theory is Kondratiev. For good summation with links, see: http://en.wikipedia.org/wiki/Kondratiev_wave

Source: http://northcoastinvestmentresearch.wordpress.com/2009/02/02/the-kondratieff-cycle/

2. Whether traders, government regulators and market pundits like it or not, markets are bound by bilateral, translational and rotational symmetries at every discrete level of transaction. That is, from the level of a one to one party exchange, to the level of large movements of funds, goods, intangibles, across borders and recorded on electronic screens. Are markets suffused with these basic symmetries or are we projecting these symmetries onto what are actually random events of the markets? Epistemologically, the limit of pattern recognition is probably fixed at the neuronal level. [See, research on "mirror neurones"--Ramachandran's "A Tell-Tell Brain" (2011) is a good place to start. My 17 year old son is writing a philosophy paper on mirror neurones and the quantum brain hypothesis, and he tells me Ramachandran is quite readable.]

3. Is it possible that those who are able to read the markets well aren't just outliers on a normal distribution, but "wired" with a particular perceptual talent. My investigations in behavioural finance led me to a tragic-hero character named Brunswik of the University of California, Berkeley, who originated pyscho-metric testing for employment back in the 1920's and who created an amazing training model for enhancing pattern-recognition, which is used to this day, for example, to train up radar engineers to make split-second decisions relating to identifying "friend or foe" fighters in hundreds of milliseconds. One of his models which i really admire is called, "Brunswik Lens Symmetry" and is a classic in pedagogical methods. I wrote a rather lame 100 question do-it-yourself-Brunswik-Lens-Symmetry test 5 years ago which I've withheld from publication. Spooky thing is that it is fairly good at predicting the character of potential employees. Anyway, Brunswik was a tragic-hero, however, because he and his wife ended their lives together in a double suicide. His lecturing style was said to be rigorous, incorporating JS Mill, critiquing the Austrian School, and forming testable social algorithms whenever he could. The reason his stuff isn't really out in the open is because of the mathematics he used. Too bad. I believe his stuff really works and could be incorporated in say training stock market operators and machines in recognising certain types of market signals.

Source: http://psycnet.apa.org/index.cfm?fa=buy.optionToBuy&id=2007-10421-008

Wednesday, 10 August 2011

The Physical End of Oil Producing Countries -> Cold Fusion v Abiotic Oil

REVOLUTIONS ARE HAPPENING EVERYWHERE. The old ways are changing. Yesterday, APL eclipsed XOMas the largest market cap company in the USA. Apple computers surpassed Exxon! FINANCE SHOULD NOT BE ABOUT ENSLAVING THE MIND IN FEARS. IT SHOULD BE ABOUT MAKING PHYSICAL LIFE HAPPY AND FUN. DO YOU BELIEVE OIL WILL BE THE ONLY FUEL OF CHOICE FOR GLOBAL CIVILISATION? WHAT IF THE PRICE OF ENERGY WERE TO FALL TO ONE-ONE HUNDREDTH OF ITS CURRENT PRICE?

1. Check this out: "Andrea Rossi is the inventor of the “Method and Apparatus for carrying out Nickel and Hydrogen Exothermal reactions” (known to the general public as E-Cat) for which international patent demand no. WO2009/125444 is pending and Italian Patent office has already been issued on April 6th, 2011 the final patent no. 0001387256."

Source: http://energycatalyzer3.com/news/231

2. Nobody really knows if Rossi has invented a new cold fusion reactor that generates enough heat to become self-sustaining, but if he has then I'd be buying nickel and whatever other special metals he uses in the process big time.

3. If Rossi's e-cat cold fusion works then the price of energy could go down very dramatically, especially, if all the ingredients to his machine are relatively abundant.

4. What would be the consequences of Rossi's invention? It could probably reduce cost of energy, but much would depend on the relative availability of the substances critical to its operation. Whatever is the rarest of substances for its operations, that substance would be the limiting factor for its distribution into the general economy.

5. Now suppose e-Cat technology or some other alternative to oil is found to be viable, then what will happen to the oil producing countries? The answer to this question depends on whether the abiotic origin of oil is true. See: http://oilgeopolitics.net/Geopolitics___Eurasia/Peak_Oil___Russia/peak_oil___russia.html

1. Check this out: "Andrea Rossi is the inventor of the “Method and Apparatus for carrying out Nickel and Hydrogen Exothermal reactions” (known to the general public as E-Cat) for which international patent demand no. WO2009/125444 is pending and Italian Patent office has already been issued on April 6th, 2011 the final patent no. 0001387256."

Source: http://energycatalyzer3.com/news/231

2. Nobody really knows if Rossi has invented a new cold fusion reactor that generates enough heat to become self-sustaining, but if he has then I'd be buying nickel and whatever other special metals he uses in the process big time.

3. If Rossi's e-cat cold fusion works then the price of energy could go down very dramatically, especially, if all the ingredients to his machine are relatively abundant.

4. What would be the consequences of Rossi's invention? It could probably reduce cost of energy, but much would depend on the relative availability of the substances critical to its operation. Whatever is the rarest of substances for its operations, that substance would be the limiting factor for its distribution into the general economy.

5. Now suppose e-Cat technology or some other alternative to oil is found to be viable, then what will happen to the oil producing countries? The answer to this question depends on whether the abiotic origin of oil is true. See: http://oilgeopolitics.net/Geopolitics___Eurasia/Peak_Oil___Russia/peak_oil___russia.html

Tuesday, 9 August 2011

Youth Riots and Broke Governments: What Loss of Faith Really Means

1. London has turned into a poor youth mobs cry for attention. Criminality is occurring, yes, but at a "copy-cat" level which means the youths are inspiring themselves to express their identity with other youths who don't belong to the moneyed society. These are the same youths in MENA who rioted in the Arab Spring air and youths in China who are part of the tens of millions vastly underpaid or under employed. These are the 100s of millions of youths throughout the world who've become the tossed salad of FAILED MONEY SYSTEMS. It's sad but the end of this story will be counted in deaths. Pray for rain. When it rains in England, nobody sane or insane can bear to go out. Some youths who had thrown bricks at a flower shop and set it on fire were casually walking away and were asked why they did that. One of them said, "We have no money today." See: http://www.bbc.co.uk/news/uk-england-london-14450248. Cameron et al better show a credible hand or London's chance at having a celebratory Olympics next year will be destroyed by a couple thousand roving gangs--much like Paris is during recent years.