1. In a nuclear chain reaction, some mass is turned into energy in a positive feedback loop so more and more energy is produced. This can happen quickly. In which case, you have a ka-boom, or it can happen more slowly and in a controlled fashion. However there is always a residual risk something in the containment system will fail, so basically, nuclear energy is safe until it isn't. And when it isn't, you have humans trying to control fundamental forces of nature. Humans exist towards the cold end of a universal temperature gradient while nuclear energy exists towards the hot end. For humans to evolve to a point where they will not be harmed by nuclear energy, well, that would be another creature altogether.

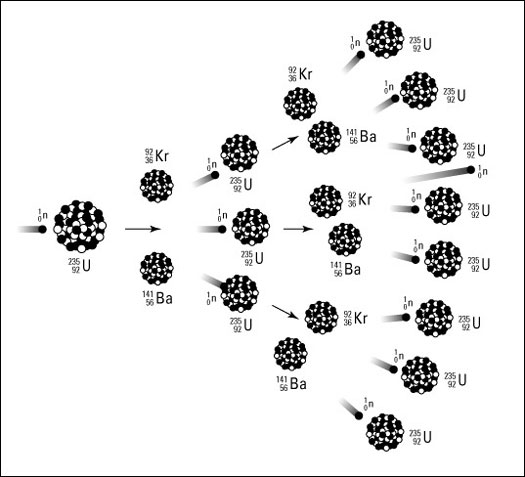

See: http://www.dummies.com/how-to/content/nuclear-fission-basics.html

2. Now what is a nuclear financial chain reaction? For our purposes, a nuclear financial chain reaction occurs when the normal bilateral symmetry of a financial contract gets re-valued for less than par but may be traded at par through a government agency. When this occurs, it is a form of deception and fraud on the taxpayer which would be self-evident grounds for rebellion if not revolution. Bankruptcy laws ex ante are intended to protect against these sorts of unjust enrichments but unfortunately, each generation needs to re-learn this ancient lesson since it is sold to contemporaries as different sorts of sheep clothing. The proposed solutions to the Greek crisis, the current form of the GSEs in the US, ie Fannie MAE and Freddy Mac, are coerced defaults, and typical CDOs all have the same structure where the forced asymmetry favours a large financial institution to the detriment of the long suffering individual financial obligors. We might call the latter "financial indentured slaves."

3. An uncontrolled nuclear chain reaction is dangerous to everyone. The same can be said about a nuclear financial chain reaction. Beautiful in theory but brutally ugly in reality.

No comments:

Post a Comment